Successful Dose Response Further Confirms Phase 3 Trial Design

Company to Hold Conference Call at 8:30 a.m. ET on Monday, January 5, 2015

MENLO PARK, Calif., Jan. 5, 2015 /PRNewswire/ — Versartis, Inc. (NASDAQ:VSAR), an endocrine-focused biopharmaceutical company that is developing a novel, long-acting form of recombinant human growth hormone (rhGH), today announced positive data from its Extension Study of VRS-317 for naive to treatment, pre-pubertal children with growth hormone deficiency (GHD). The Extension Study is a long-term safety study initiated in March 2014 as patients completed the Versartis’ Phase 1b/2a clinical trial of VRS-317 in children with GHD.

“Data obtained after 12 months of continuous dosing with VRS-317 are very encouraging as they further demonstrate the safety and efficacy of our long-acting form of recombinant growth hormone,”

said Jeffrey L. Cleland, PhD, Chief Executive Officer.

“In the group of patients in the Extension Study who were moved from a weekly dose of 1.15 mg/kg in the Phase 2a trial to a semi-monthly dose of 3.5 mg/kg in the Extension Study, we saw an increase in IGF-I levels as predicted by our PK/PD model. After 6 months in the Extension Study, the IGF-I levels of the patients who were moved to the 3.5 mg/kg semi-monthly dose were almost a full standard deviation higher than the IGF-I levels of the patients who received the 2.5 mg/kg semi-monthly dose. Furthermore, a subset of this group who were treated for 6 months at the higher dose recorded an average increase in height velocity of nearly two centimeters per year from the first 6 months to the second 6 months. Typically, a decrease in height velocity in the second 6 months of treatment would be expected for daily growth hormone therapy. These results clearly demonstrate a dose response in both IGF-I levels and height velocity providing further confirmation of the VRS-317 semi-monthly dose of 3.5 mg/kg selected for our Phase 3 VELOCITY Study.”

Dr. Cleland continued,

“The Extension Study continued to show that VRS-317 is well tolerated and that the safety profile is comparable to daily growth hormone therapy. There were no unexpected or serious adverse events and the few events noted were mild and transient. The number of adverse events declined in the second 6 months of therapy and there were no new adverse events or increases in adverse events for patients switching doses, giving us further confidence in the safety of using the 3.5 mg/kg semi-monthly dose in the Phase 3 trial. We believe the results to date from the Extension Study further demonstrate our ability to select a dose and regimen with the potential to achieve the desired efficacy in the Phase 3 study. We remain on track to launch our global Phase 3 VELOCITY Study in early 2015.”

The data presented below is included in the most recent corporate presentation, entitled “Versartis Corporate Presentation – January 2015”, and is available online within the “EVENTS AND PRESENTATIONS” section of the Company’s investor relations website at http://ir.versartis.com/events.cfm.

Extension Study Demonstrates Dose Response

The Extension Study was designed to allow all pediatric GHD patients in the previous VRS-317 clinical trials to continue to receive treatment prior to potential marketing authorization. Approximately 95% of patients completing the Phase 2a study elected to continue treatment and enroll in the Extension Study. As part of the Extension Study, the Company increased the dosing for a subset of the patient population such that 20 patients on the 1.15 mg/kg weekly dose in Phase 2a were switched to 3.5 mg/kg semi-monthly, the same dose that will be used in the upcoming global Phase 3 trial. These patients achieved a mean IGF-I SDS of 0.5, which is in the upper part of the therapeutic range and nearly a full standard deviation higher than the mean IGF-I SDS of -0.4 experienced by patients receiving the 2.5 mg/kg semi-monthly dose. This increase in IGF-I was achieved without overexposure to IGF-I.

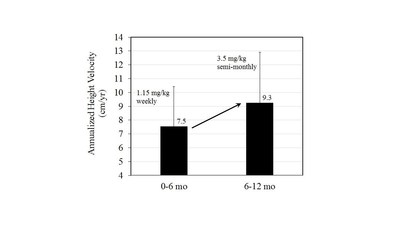

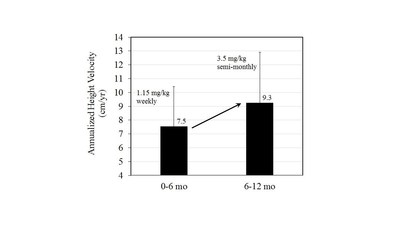

More importantly, as seen below, a subset of patients in this group who were treated for 6 full months at the higher dose recorded an increase in mean annualized height velocity of nearly two centimeters per year, from 7.5 cm/year in the first 6 months to 9.3 cm/year in the second 6 months. Typically, a decrease in height velocity in the second 6 months of treatment would be expected for daily rhGH therapy. The 3.5 mg/kg semi-monthly dose was selected based upon confirmation of the Company’s PK/PD model from its Phase 1b study.

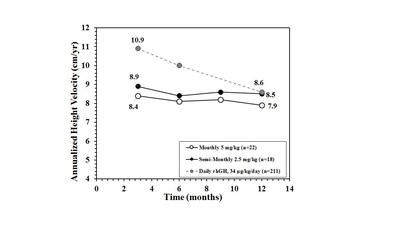

Lower Waning of Growth Rates Over First 12 Months

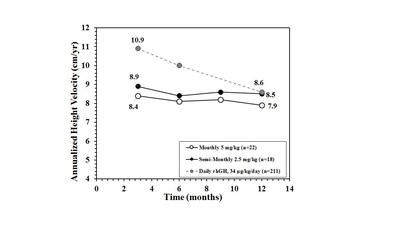

As shown below, the mean height velocity measured after 12 months of continuous VRS-317 therapy for the patients who remained on the 5 mg/kg monthly and 2.5 mg/kg semi-monthly doses in the Extension Study was not significantly different from the mean height velocity observed in the same patients at 3, 6, and 9 months. In addition, the mean height velocity for patients completing 12 months of treatment at 2.5 mg/kg semi-monthly was 8.5 cm/year, which is consistent with the first year growth rate for moderate GHD patients receiving the highest approved dose on the labels of Genotropin® or Norditropin®.

The Company believes the lower waning of height velocity over time with VRS-317 compared to that typically observed with daily growth hormone therapy suggests that a more consistent pattern of growth may be occurring in VRS-317 patients compared to patients on daily growth hormone therapy.

Safety Profile of VRS-317 Comparable to Daily rhGH Therapy

The safety profile of VRS-317 in all patients over 12 months of continuous VRS-317 therapy was comparable to daily growth hormone therapy. There were no unexpected or serious adverse events and the few events noted were mild and transient. The number of adverse events declined in the second 6 months of therapy and only a minority of patients reported any adverse events. There were no new adverse events or increases in adverse events for patients switching to the 3.5 mg/kg VRS-317 semi-monthly dose. There were only minimal transient excursions of IGF-I SDS above 2 and no excursions above 3. Throughout the second 6 months in the Extension Study, dose administration was performed at home by the parent or caregiver with nearly complete compliance with the schedule of dosing.

Conference Call and Webcast

Versartis will hold a conference call on Monday, January 5, 2015 at 8:30 a.m. ET (5:30 a.m. PT). The dial-in numbers are (877) 407-0789 for domestic callers and (201) 689-8562 for international callers. A live webcast of the conference call will be available online from the investor relations page of the Company’s corporate website at www.versartis.com.

After the live webcast, a replay will remain available on the Versartis website, www.versartis.com, for 90 days. In addition, a telephonic replay of the call will be available until January 19, 2015. The replay dial-in numbers are (877) 870-5176 for domestic callers and (858) 384-5517 for international callers. Please use the replay conference ID number 13598346.

The VRS-317 VELOCITY Study

The Versartis Long-Acting Growth Hormone in Children compared To Daily rhGH (VELOCITY) Study is a randomized, open-label, Phase 3 registration study in the United States, Western Europe and Canada. This study is expected to enroll up to 136 naïve to treatment, pre-pubertal children with GHD and will include a 3:1 randomization of 3.5 mg/kg VRS-317 semi-monthly to daily rhGH at the highest approved dose on the labels of Genotropin® (somatropin [rDNA origin] for injection) and Norditropin® (somatropin [rDNA origin] for injection) 34 mcg/kg/day. The primary endpoint is non-inferiority between the two treatment groups for 12 month height velocity. GHD patients enrolling in this study will also be offered the opportunity to enroll in the ongoing pediatric Extension Study after completing the Phase 3 study.

About Versartis

Versartis, Inc. is an endocrine-focused biopharmaceutical company initially developing VRS-317, a novel, long-acting form of recombinant human growth hormone, for the treatment of growth hormone deficiency (GHD). VRS-317 is intended to reduce the burden of daily injection therapy by requiring significantly fewer injections, potentially improving compliance and, therefore, treatment outcomes. The Company completed a Phase 2a clinical trial evaluating weekly, semi-monthly and monthly dosing regimens of VRS-317 in children with GHD in June 2014 and is initiating a Phase 3 study in the same patient population in early 2015. Further information on Versartis can be found at www.versartis.com.

Cautionary Note on Forward-Looking Statements

This press release contains forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We may, in some cases, use terms such as “expects,” “intend,” “potential,” “will” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Forward-looking statements include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things: plans regarding our anticipated Phase 3 VELOCITY Study, the potential efficacy of the selected Phase 3 dose of VRS-317 and potential safety, efficacy and other benefits of and market opportunity for VRS-317. These statements are subject to risks and uncertainties that could cause actual results and events to differ materially from those anticipated, including, but not limited to, risks and uncertainties related to: our success being heavily dependent on VRS-317; VRS-317 being a new chemical entity; the potential for serious adverse side effects, if they are associated with VRS-317; VRS-317 may not have favorable results in later clinical trials or receive regulatory approval; other long-acting rhGH products and product candidates have failed to generate commercial success or obtain regulatory approval; delays in enrollment of patients in our clinical trials could increase our costs and cause delay; VRS-317 may cause serious adverse side effects or have properties that delay or prevent regulatory approval or limit its commercial profile; we may encounter difficulties in manufacturing VRS-317; if approved, risks associated with market acceptance, including pricing and reimbursement; our ability to enforce our intellectual property rights; the importance of our license of intellectual property from Amunix Operating, Inc. and our need for additional funds to support our operations. We discuss many of these risks in greater detail under the heading “Risk Factors” section contained in our Quarterly Report on Form 10-Q for the 3 months ended September 30, 2014, which is on file with the Securities and Exchange Commission (SEC). Forward-looking statements are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this press release. Any forward-looking statements that we make in this press release speak only as of the date of this press release. We assume no obligation to update our forward-looking statements whether as a result of new information, future events or otherwise, after the date of this press release.

Contacts:

Corporate

Joshua Brumm

Chief Financial Officer

(650) 963-8582

IR@versartis.com

Investors

Nick Laudico

The Ruth Group

(646) 536-7030

nlaudico@theruthgroup.com

Media

Debra Bannister

Corporate Communications

(530) 676-7373

media@versartis.com

SOURCE Versartis, Inc.

News Provided by Acquire Media

MENLO PARK, Calif., Jan. 8, 2015 (GLOBE NEWSWIRE) — Versartis, Inc. (Nasdaq:VSAR), an endocrine-focused biopharmaceutical company that is developing a novel, long-acting form of recombinant human growth hormone (rhGH), today announced the initiation of its Phase 3 study of VRS-317 for semi-monthly dosing in children with growth hormone deficiency (GHD). This registration trial follows positive data from the Company’s completed Phase 1b/2a VERTICAL study and the ongoing long-term Extension Study.

MENLO PARK, Calif., Jan. 8, 2015 (GLOBE NEWSWIRE) — Versartis, Inc. (Nasdaq:VSAR), an endocrine-focused biopharmaceutical company that is developing a novel, long-acting form of recombinant human growth hormone (rhGH), today announced the initiation of its Phase 3 study of VRS-317 for semi-monthly dosing in children with growth hormone deficiency (GHD). This registration trial follows positive data from the Company’s completed Phase 1b/2a VERTICAL study and the ongoing long-term Extension Study.